Roadmap

Subsequent to the UX Mainnet Launch in February 2022, the UX core team has successfully shipped several major protocol upgrades to onboard the most innovative features for cross-chain lending. So far, we have successfully built

- The first Cosmos native leverage blockchain

- UX gravity bridge that connects with Ethereum

- The first smart oracle, Historacle, for crypto

- IBC rate limiting

Moving forward, the network will showcase a series of enhanced functionalities and additional use cases, all aimed at improving the cross-chain DeFi experience. These advancements will be delivered through three distinct phases: Marina, Hali, and Yara.

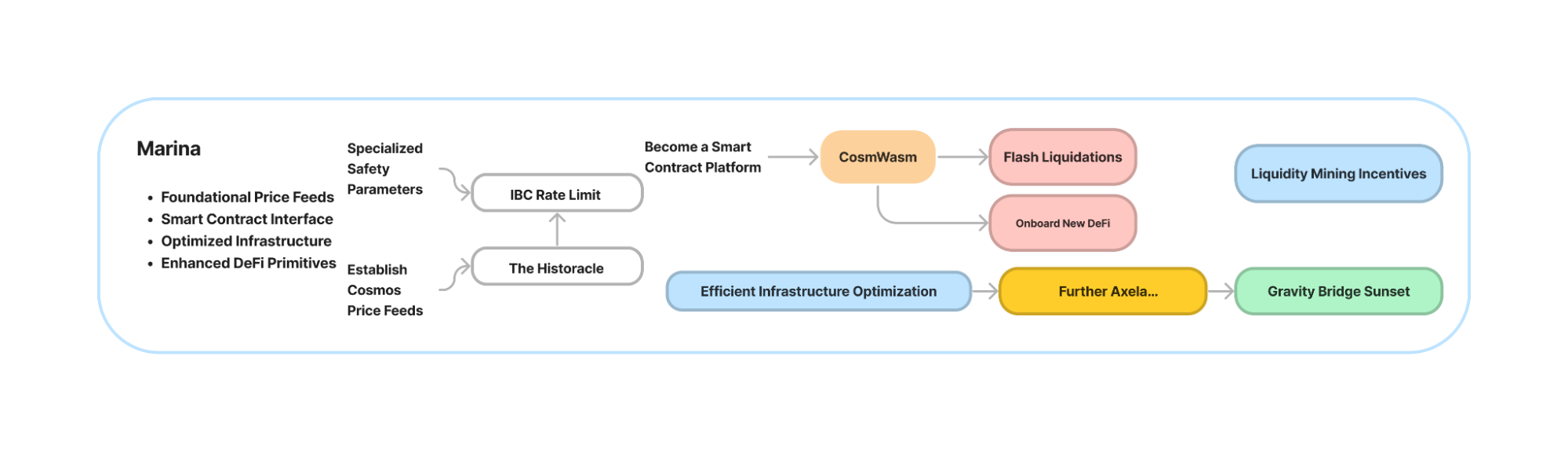

Marina

- Leverage our foundational price feeds to expand the range of DeFi products, incorporating safety parameters via the IBC rate limiting module.

- Establish a robust smart contract framework to facilitate the seamless onboarding of dApps onto the UX chain.

- Optimize UX's infrastructure to minimize validator operational costs and overhead, thereby enhancing overall efficiency.

- Provide community incentives to foster the growth and expansion of the UX ecosystem.

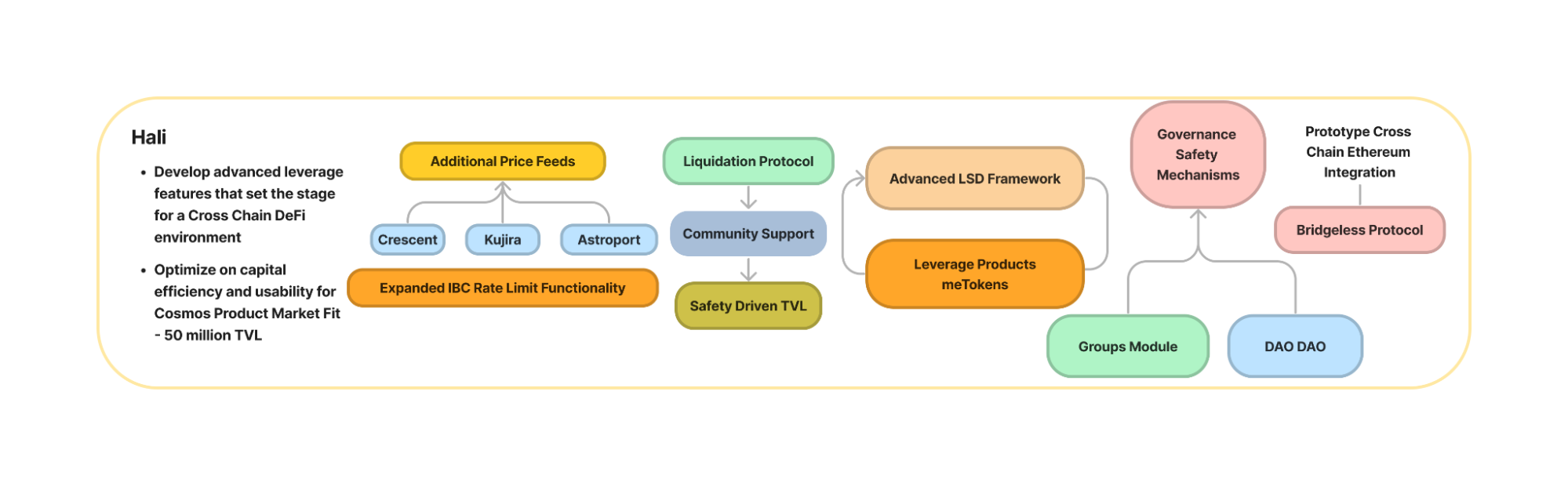

Hali

- Expansion of leverage offerings to accommodate diverse use cases and markets, with a portfolio of over 20 tokens available for lending and borrowing.

- Introduction of an improved Liquidation Protocol to ensure the stability of the loan stack, implementing incremental position liquidation (approximately 5%) for effective loan rebalancing.

- Enhancement of governance features to address emergency scenarios and establish robust response mechanisms.

- Development of a cross-chain interface prototype with the Ethereum ecosystem, enabling seamless interoperability and broader accessibility for UX.

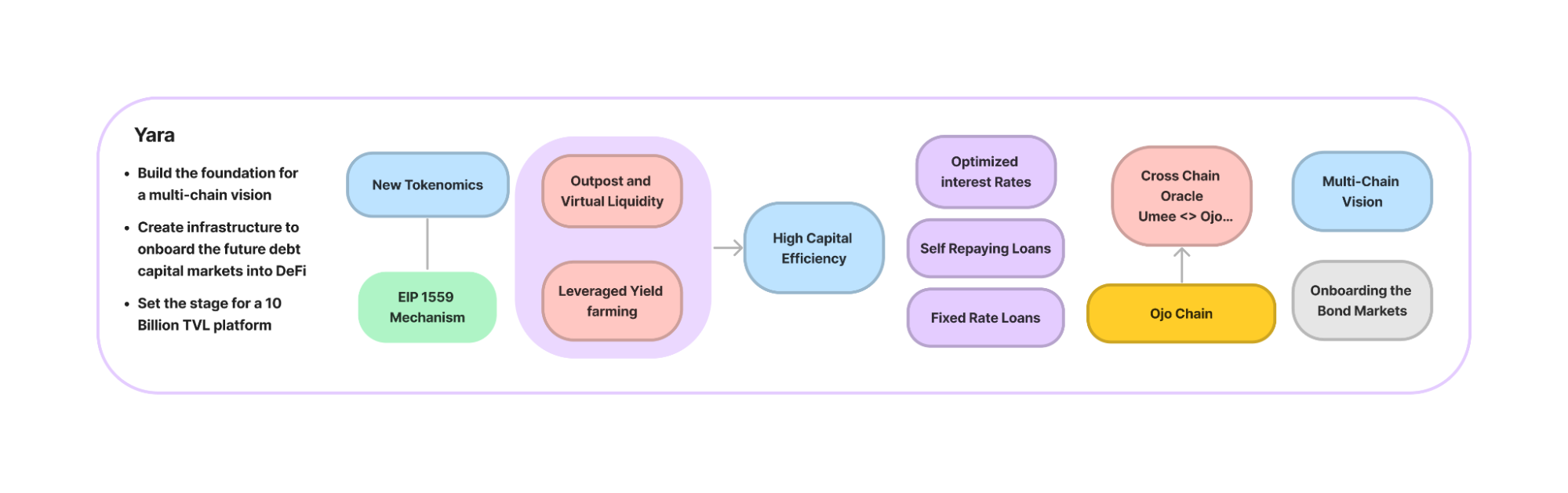

Yara

- Implementation of new tokenomics to optimize the crypto-economics of the entire UX network.

- Introduction of Outpost and Virtual Liquidity mechanisms to showcase the extended functionality of DeFi money legos, allowing users to effortlessly create a wide range of financial products using UX technology.

- Integration of superior interest rate algorithms to enhance the lending experience, accompanied by innovative fixed duration lending tools for the development of a native cryptocurrency yield curve. This shift ensures a departure from opportunistic capital practices, instilling confidence in market-driven rates.

- Pursuit of a multi-chain vision to integrate the broader crypto ecosystem into the IBC network, expanding UX's presence across various chains.

- Expansion of product development to onboard the global bond markets into the realm of DeFi. With an estimated $200T in the global debt market, UX aims to capture significant potential while only scratching the surface.